I take great pleasure in announcing my new role as Research Associate at Impact Lens to implement effective assessment for responsible and sustainable investing. As our chairman John Ditchfield said in a Financial Times Moral Money webinar, finance is perhaps the only industry that offers products disconnected with societal needs. Only until recently the industry realized they can no longer lay waste the planet and beginning to tailor ESG funds to match with clients’ care for social and environmental impacts of their investments, including pensions.

With more sustainable funds emerging in the market, Impact Lens designed a comprehensive and objective assessment methodology to benchmark impact performance across different funds against CFA ESG metrics and UNSDGs. This prevents greenwashing of funds and allow clients to make informed investment choices that bring tangible positive impacts.

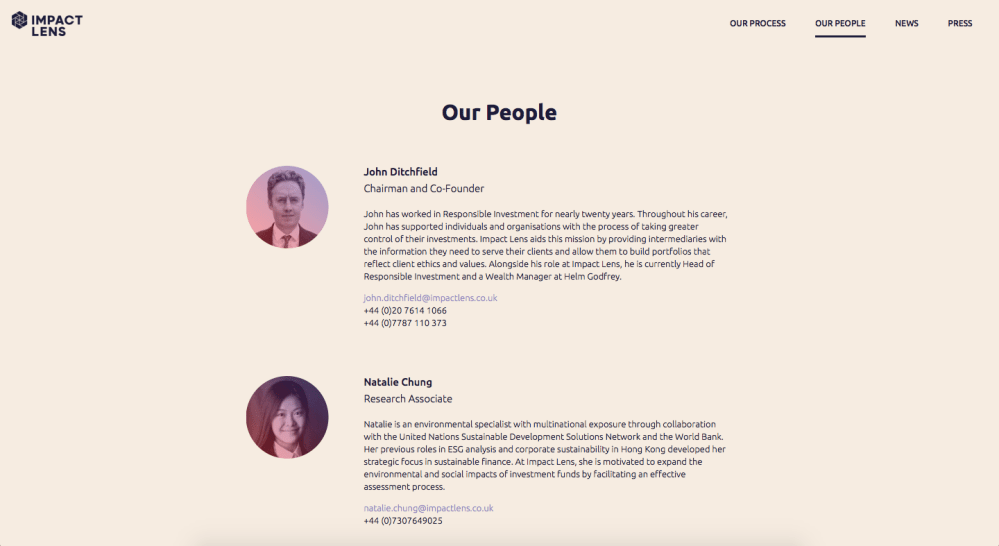

Remote working under COVID-19 often means “less interactive” online meetings and webinars, but it has been a productive learning process under John’s mentorship. John is exceptionally patient in guiding me through the finance jargons and steps in the assessment processes. I remember clearly in one meeting he revisited my CV and asked among my diverse experience, what was my initial motivation of joining Impact Lens. I thought for a brief moment, running through my experience at multilateral and local organizations, with work ranging from education, activism to advocacy, I felt on the ground the impact of financing in various settings. How do we draw vast amount of capital resources to support meaningful projects? With more people paying attention to ethical investment, how can we bridge the gap between sustainable financial products in the market and customers’ need? I believe in the power of finance in changing behaviour and driving fundamental change how the society works.

The pandemic reveals how resilient and future-proof sectors continue to thrive under the volatile economy. It is ever more important to review our investment decisions and make sustainable funds credible and accessible.